-

- Государственные органы республиканского и территориального уровня;

- Министерство финансов РК;

- Министерство экономического развития и торговля РК;

- Национальный банк РК;

- Агентство РК по регулированию и надзору деятельности финансового рынка и финансовых организаций;

- экономические службы Министерств и ведомств;

- бюджетные учреждения и организации;

- хозяйствующие субъекты различных организационно-правовых форм;

- аудиторские компании;

- консалтинговые компании;

- государственные предприятия;

- крупные фирмы и банки;

- отделы контроллинга и внутреннего аудита.

Государственные органы, учреждения и организации всех форм собственности, органы управления государственного регулирования экономики в звеньях рыночной инфраструктуры.

Активы организации, ее обязательства, капитал и хозяйственные операции, вызывающие изменения в составе, размещении активов и источников его формирования, а также деятельность организаций различных отраслей экономики с учетом специфики отрасли: государственные органы управления, научно-исследовательские учреждения, организации и фирмы независимо от их организационно – правовой формы

- сбор учетной и статистической информации, обработка данных и подготовка ее к использованию руководителями при принятии управленческих решений, инвесторами, кредиторами, внешними и внутренними пользователями;

- анализ и оценка альтернативных решений по ценообразованию, инвестициям, методам производства;

- управление и контроль над деятельностью организации в целом;

- проверка соответствия ведения бухгалтерского учета законодательно-нормативным актам, а также оказание консультативных услуг (аудиторская и консалтинговая деятельность);

- составление финансовой отчетности в соответствии с МСФО;

- составление консолидированной финансовой отчетности;

- составление налоговой отчетности и заполнение деклараций по налогам;

- восстановление и перевод бухгалтерского учета в соответствии с МСФО;

- разработка нормативных актов, регулирующих бухгалтерский учет (нормативно-методическая деятельность).

1. Оценочные:

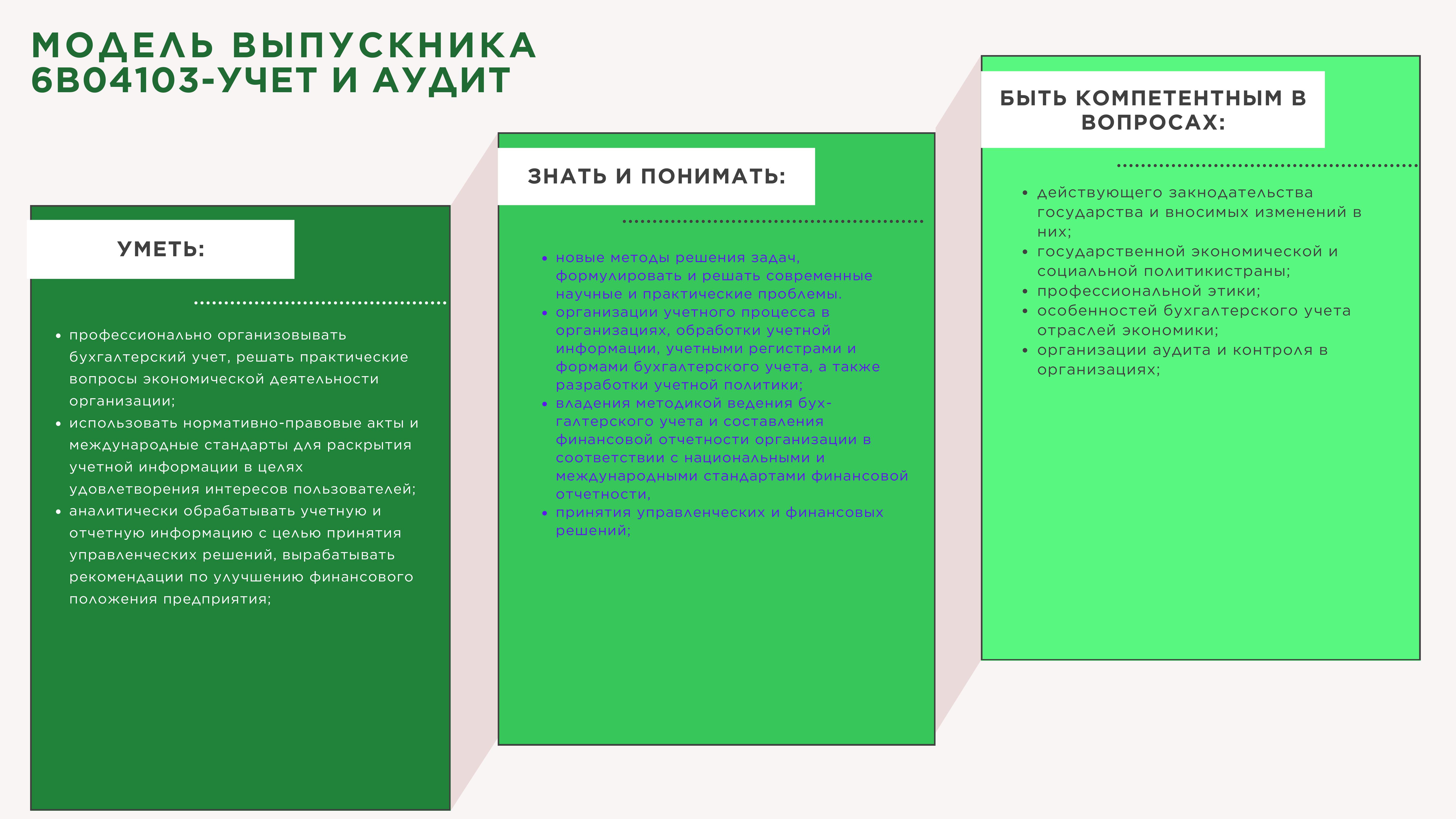

- профессионально организовывать бухгалтерский учет, решать практические вопросы экономической деятельности организации;

- использовать нормативно- правовые акты и международные стандарты для раскрытия учетной информации в целях удовлетворения интересов пользователей;

- аналитически обрабатывать учетную и отчетную информацию с целью принятия управленческих решений, вырабатывать рекомендации по улучшению финансового положения предприятия;

2. Конструктивные:

- новые методы решения задач, формулировать и решать современные научные и практические проблемы.

- организации учетного процесса в организациях, обработки учетной информации, учетными регистрами и формами бухгалтерского учета, а также разработки учетной политики;

3. Информационно-технологические:

- владения методикой ведения бухгалтерского учета и составления финансовой отчетности организации в соответствии с национальными и международными стандартами финансовой отчетности,

- принятия управленческих и финансовых решений.

- действующего закнодательства государства и вносимых изменений в них;

- государственной экономической и социальной политикистраны;

- профессиональной этики;

- особенностей бухгалтерского учета отраслей экономики;

- организации аудита и контроля в организациях.